Experior Financial Group Inc. Michael Smith

in Barrie

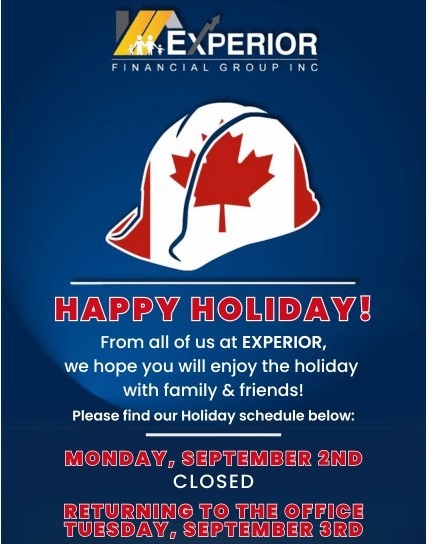

On September 03

at 7:44 AM

Experior Financial Group Inc. Michael Smith

in Barrie

On August 02

at 1:15 PM

Experior Financial Group Inc. Michael Smith

in Barrie

On July 02

at 8:52 AM

Experior Financial Group Inc. Michael Smith

in Barrie

On June 25

at 9:10 AM

Experior Financial Group Inc. Michael Smith

in Barrie

On June 24

at 11:26 AM

Page 4 of 20